The Future of Financial Technology

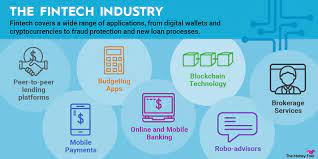

Financial technology, or fintech, is revolutionizing the way we manage our money, make transactions, and access financial services. With the rapid advancement of technology, the financial industry is undergoing a significant transformation that is reshaping how we interact with money.

One of the key aspects of fintech is its focus on improving efficiency and convenience for consumers. Through mobile banking apps, online payment platforms, and digital wallets, individuals can now easily monitor their finances, transfer money, pay bills, and make investments with just a few taps on their smartphones.

Furthermore, fintech has democratized access to financial services by providing solutions for underserved populations. Peer-to-peer lending platforms, robo-advisors, and micro-investment apps have opened up new opportunities for individuals who were previously excluded from traditional banking systems.

Artificial intelligence and machine learning are playing a crucial role in enhancing the accuracy and speed of financial decision-making. These technologies are being used to analyze vast amounts of data to detect fraud, assess credit risk, personalize investment recommendations, and optimize trading strategies.

Blockchain technology is another disruptive force in the financial industry. By enabling secure and transparent peer-to-peer transactions without the need for intermediaries, blockchain has the potential to revolutionize payment processing, cross-border remittances, smart contracts, and asset tokenization.

Looking ahead, the future of financial technology promises even greater innovation and evolution. As technologies such as quantum computing, biometrics authentication, Internet of Things (IoT), and decentralized finance (DeFi) continue to mature, we can expect to see further advancements in how we manage our finances.

In conclusion, financial technology is reshaping the landscape of the financial industry by making services more accessible, efficient, secure, and personalized. Embracing these technological advancements will not only benefit consumers but also drive economic growth and foster greater financial inclusion worldwide.

7 Essential Tips for Navigating the Financial Technology Landscape Safely and Effectively

- Stay informed about the latest trends and developments in financial technology.

- Understand the potential risks associated with using financial technology services.

- Compare different fintech products and services to find the ones that best suit your needs.

- Protect your personal and financial information when engaging with fintech platforms.

- Consider diversifying your investments through fintech tools like robo-advisors or peer-to-peer lending platforms.

- Take advantage of budgeting and money management apps offered by fintech companies to improve your financial health.

- Be cautious of scams or fraudulent activities in the fintech space and report any suspicious behavior.

Stay informed about the latest trends and developments in financial technology.

Staying informed about the latest trends and developments in financial technology is crucial for individuals and businesses looking to leverage the benefits of fintech. By keeping up-to-date with emerging technologies, regulatory changes, and innovative solutions in the financial industry, you can make informed decisions, adapt to market shifts, and stay ahead of the curve. Continuous learning and awareness of fintech trends not only enhance your financial knowledge but also empower you to capitalize on new opportunities and navigate the ever-evolving landscape of modern finance effectively.

Understand the potential risks associated with using financial technology services.

It is crucial for users of financial technology services to have a clear understanding of the potential risks involved. While fintech offers convenience and efficiency, it also comes with certain vulnerabilities such as data breaches, cyber attacks, identity theft, and fraudulent activities. By being aware of these risks, users can take proactive measures to safeguard their personal and financial information, such as using strong passwords, enabling two-factor authentication, monitoring account activities regularly, and staying informed about the latest security best practices. Being informed about the risks associated with fintech services empowers users to make informed decisions and protect themselves from potential threats in the digital financial landscape.

Compare different fintech products and services to find the ones that best suit your needs.

When delving into the realm of financial technology, it is essential to compare different fintech products and services to pinpoint the ones that align most closely with your specific needs and preferences. By conducting thorough comparisons, you can identify solutions that offer the features, functionality, and benefits that are most relevant to your financial goals. Whether you are seeking streamlined banking services, robust investment platforms, or innovative payment solutions, exploring and evaluating various fintech options empowers you to make informed decisions that optimize your financial management experience.

Protect your personal and financial information when engaging with fintech platforms.

It is crucial to prioritize the security of your personal and financial information when utilizing fintech platforms. Safeguarding sensitive data such as bank account details, social security numbers, and passwords is essential to prevent identity theft and financial fraud. Be vigilant in choosing reputable fintech services that employ robust encryption protocols, two-factor authentication, and regular security updates to ensure the confidentiality and integrity of your information. By staying proactive and mindful of cybersecurity best practices, you can enjoy the benefits of financial technology while minimizing the risks associated with online transactions.

Consider diversifying your investments through fintech tools like robo-advisors or peer-to-peer lending platforms.

When exploring opportunities in financial technology, it is advisable to consider diversifying your investments through innovative tools such as robo-advisors or peer-to-peer lending platforms. These fintech solutions offer accessible and automated ways to spread your investment portfolio across different assets, reducing risk and potentially increasing returns. By leveraging the capabilities of robo-advisors for personalized investment strategies or participating in peer-to-peer lending for alternative financing options, you can enhance your investment portfolio’s resilience and explore new avenues for growth in the ever-evolving financial landscape.

Take advantage of budgeting and money management apps offered by fintech companies to improve your financial health.

By utilizing budgeting and money management apps provided by fintech companies, individuals can enhance their financial well-being. These innovative tools offer features such as expense tracking, goal setting, automated savings, and personalized insights to help users effectively manage their finances. By leveraging the convenience and efficiency of these apps, individuals can gain better control over their spending habits, save more effectively, and work towards achieving their financial goals with greater ease and confidence.

Be cautious of scams or fraudulent activities in the fintech space and report any suspicious behavior.

In the realm of financial technology, it is crucial to exercise caution and vigilance against scams or fraudulent activities that may target unsuspecting individuals. It is important to stay informed and aware of common tactics used by scammers in the fintech space, such as phishing emails, fake websites, or fraudulent investment schemes. If you encounter any suspicious behavior or suspect fraudulent activity, do not hesitate to report it to the appropriate authorities or financial institutions to help protect yourself and others from falling victim to financial fraud.

Tags: access financial services, advancement of technology, artificial intelligence, consumers, convenience, democratized access to financial services, digital wallets, efficiency, financial technology, fintech, industry transformation, interact with money, machine learning, make investments, manage money, micro-investment apps, mobile banking apps, monitor finances, online payment platforms, pay bills, peer-to-peer lending platforms, revolutionizing, robo-advisors, transactions, transfer money, underserved populations